Payroll Management System

Payroll Management System Software Services One of the integral parts of HR is Payroll. Timely and accurate salary and wages calculation coupled with Statutory Compliance is automatically expected. The task of payroll becomes complicated in today's industries due to multiple statutory requirements, MIS requirements, calculations based on slabs and formulas and other HR policies. Our Payroll Software make this complicated function look much easier. The payroll software is user-friendly, with user-definable preferences like Salary Heads and Salary structures, huge library of periodical statutory reports required under PF & ESI, TDS Law, Advance Register, Leave Register, flexible reporting and many more. This is a known better solution for Indian Payroll, where the payroll software suits salary processing, time attendance interface, Excel interface, HR [Human Resource] management, and many more... Now everything what you need in a Salary Software [or so called Payroll Software, India] is available in a single place with finger tip access. We provide all the payroll solutions whether you need multiple structures or customized reporting, our aim is to deliver low cost customized solutions to our clients. Our use of technology makes it possible to provide payroll software solution for your requirement, whether in different reporting methodologies or in scalable back-ends [databases] such as MS-Access, Oracle, MS-SQL or MySQL! We offer what you require... Our experienced team includes High skilled project managers, Quality control personnel, Technical engineers, Domain Experts, Payroll Processors/Professors and highly qualified Testing and implementation team. We offer unique production capabilities to implement payroll software on time and to budget and provide comprehensive product control for client's requirement and expert technical skills to provide quality HR-Salary or payroll solution at minimal cost. Salient Features of our payroll software

- Flexible definition of working days/holidays depending on leave groups

- Complete leave management

- HR details management

- TDS Computation, eTDS Generation & Printing of TDS certificates and Returns

- Exporting Salary details to Accounting Software

- Network Compatible Client Server Architecture with optional backend, available with Oracle/MS SQL/My SQL/ MS Access etc.

Features of a Payroll Management System

-

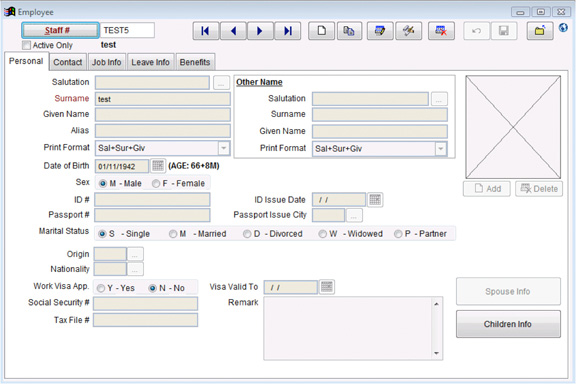

Employee Information Management

-

Stores and manages employee details, such as personal information, job roles, and salary structures.

-

-

Salary Calculation

-

Automatically calculates gross salaries, net pay, and deductions (e.g., taxes, insurance, retirement contributions).

-

Handles overtime, bonuses, and allowances.

-

-

Tax Management

-

Calculates and deducts income tax, social security, and other statutory deductions.

-

Generates tax reports and files tax returns.

-

-

Payslip Generation

-

Creates and distributes digital or printable payslips for employees.

-

Includes details like gross pay, deductions, and net pay.

-

-

Direct Deposit and Payment Processing

-

Facilitates direct deposit of salaries into employees’ bank accounts.

-

Supports multiple payment methods (e.g., checks, e-wallets).

-

-

Leave and Attendance Integration

-

Integrates with attendance systems to calculate salaries based on working hours, leaves, and absences.

-

Tracks paid time off (PTO) and sick leaves.

-

-

Compliance Management

-

Ensures compliance with labor laws, tax regulations, and reporting requirements.

-

Updates automatically with changes in regulations.

-

-

Reporting and Analytics

-

Generates payroll reports, such as payroll summaries, tax reports, and employee earnings.

-

Provides insights into payroll costs and trends.

-

-

Employee Self-Service Portal

-

Allows employees to access their payslips, tax forms, and leave balances.

-

Enables employees to update personal information.

-

-

Multi-Currency and Multi-Country Support

-

Handles payroll for global teams with support for multiple currencies and tax systems.

-

-

Integration Capabilities

-

Integrates with other HR and accounting systems (e.g., HRMS, ERP).

-

Benefits of a Payroll Management System

-

Accuracy

-

Reduces manual errors in salary calculations and tax deductions.

-

-

Time Savings

-

Automates repetitive tasks, saving time for HR and finance teams.

-

-

Compliance

-

Ensures adherence to local labor laws and tax regulations.

-

-

Cost Efficiency

-

Reduces administrative costs and minimizes penalties for non-compliance.

-

-

Transparency

-

Provides employees with clear and detailed payslips.

-

-

Scalability

-

Adapts to the growing needs of the organization, from small businesses to large enterprises.

-

Types of Payroll Management Systems

-

Cloud-Based Systems

-

Hosted on remote servers and accessible via the internet.

-

Offers flexibility, scalability, and automatic updates.

-

-

On-Premise Systems

-

Installed on the company’s local servers.

-

Provides full control over data and customization.

-

-

Integrated HR and Payroll Systems

-

Combines payroll management with other HR functions (e.g., recruitment, performance management).

-

-

Standalone Payroll Systems

-

Focuses solely on payroll processing and management.

-